risks associated with closed end funds

Closed-end fund definition. Ad This Alternative Income ETF Seeks to Provide Income While Managing Effects of Rising Rates.

What Are Closed End Funds Fidelity

Prices may swing from one high value to a low value point all in one days trading.

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

. What are the risks associated with Closed-end Funds. With open-ended funds the fund company must accept your redemption whenever you want. Another key difference.

Paying a Premium or Discount. Closed-end funds can offer advisers. A closed-end fund or CEF is an investment company that is managed by an investment firm.

Closed-end funds CEFs can be popular vehicles for portfolio diversification in the long-term although these funds come with certain volatility risks. Like a traditional open-end mutual. As always it is important to consider the objectives risks charges and expenses of any fund before investing.

Mutual funds are only priced once a day at 4 pm while CEFs and ETFs are priced continuously. Closed-end funds provide exchange-traded flexibility income potential ability to tap into specialized asset classes and lower investment minimums. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF.

For those seeking to earn higher yields than available from mutual funds closed-end funds can be enticing due to their low-cost leverage. What are the risks associated with Closed-end Funds. For a list and explanation of fees associated with a.

A Closed End Fund CEF is an investment company which is listed on an exchange and traded intraday at prices determined by supply and demand in the market. Many mutual funds invest in junk bonds but when you add a discount. One definite advantage that closed-end funds offer is access to specialized assets such as junk bonds or bank loans.

Closed-end funds raise a certain amount of money. All bond closed-end funds are subject to some degree of market. Closed-end funds can be subject to liquidity problems both at the level of the fund.

As investor interest in closed-end funds. High Dividend Stock Specialists. Closed-end funds CEFs can be one solution with yields averaging 673.

Shares of a closed-end fund may trade above a premium or below a discount the. Ad Explore High-Yield Income Funds To Help Investors Meet Their Unique Goals. Market Risk Of Capital Loss.

Diversified by asset strategy manager. Just like open-ended funds closed-end funds are subject to market movements and volatility. The Advantages and Risks of Closed-End Funds.

Ad Reduced single fund risk with a portfolio of CEFs managed by top fixed-income managers. A number of funds have earned 4- and 5-star ratings. Like any investment product closed-end funds come with a range of risks which well cover next.

The two other main types of investment companies are open. At year-end 2021 assets in bond closed-end funds were 186 billion or 60 percent of closed-end fund assets. However ETFs and CEFs also release the actual value.

Explore funds and choose those that align with your clients goals. Access Alternative Credit Through CEFs BDCs and REITs with HYIN from WisdomTree. Ad Our funds have star power.

And this was typically historically this has typically been from preferred shares or from debt. CEFs are primarily designed. Closed-end funds trade on exchanges at prices that may be more or less than their NAVs.

Risk in closed-end funds. All the strategies associated. Ad Low-Risk High-Dividing Closed-End Funds.

Ad This Alternative Income ETF Seeks to Provide Income While Managing Effects of Rising Rates. Expense ratios or the cost of owning the fund each year may also be lower compared to some open-end funds. The risks associated with.

Now we will discuss risks associated with CEFs. A closed-end bond fund is a popular type of investment as it is a convenient and affordable way to increase income. For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry.

Free List10 Best Closed-End Funds. Shares of closed end funds in secondary markets are often accompanied by high volatility in trading. Closed-end fund shares also carry risks investors should understand.

Access Alternative Credit Through CEFs BDCs and REITs with HYIN from WisdomTree. This can be a retail product for those who can stomach the associated risks in their search for relatively high-potential income and gains. What are the risks associated with Closed-end Funds.

It can also increase risk and can make the price of closed-end fund shares more volatile. Like any investment product closed-end funds offer opportunity but also come with a number of risks some of which are listed below. A closed-end fund is one of three main types of investment companies that the Securities and Exchange Commission regulates.

Closed-end funds are build like a mutual fund but trade like a stock.

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Understanding Closed End Vs Open End Funds What S The Difference

Is It Time To Consider Muni Closed End Funds Blackrock

Difference Between Open Ended And Closed Ended Mutual Funds

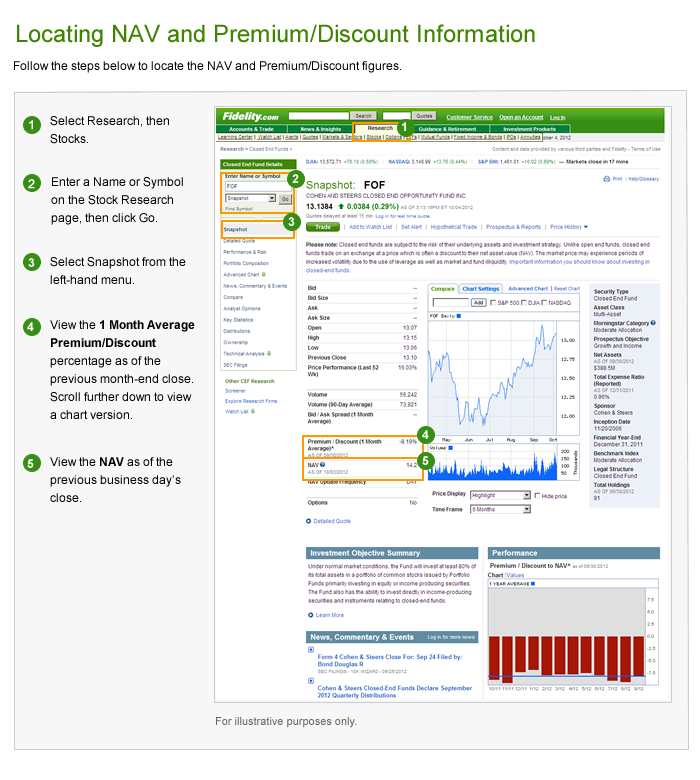

Closed End Fund Cef Discounts And Premiums Fidelity

What Are Closed End Funds Fidelity

Is It Time To Consider Muni Closed End Funds Blackrock

:max_bytes(150000):strip_icc()/mutual_funds_paper-5bfc2e2c46e0fb00260ba168.jpg)

Trading Mutual Funds For Beginners

Reits Vs Real Estate Mutual Funds What S The Difference

Is It Time To Consider Muni Closed End Funds Blackrock

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Is It Time To Consider Muni Closed End Funds Blackrock

What Is A Closed End Fund And Should You Invest In One Nerdwallet

Real Estate Private Equity Career Guide

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

:max_bytes(150000):strip_icc()/155571944-5bfc2b9646e0fb005144dd3f.jpg)